Presenter

Dana Watt, Breakout Ventures

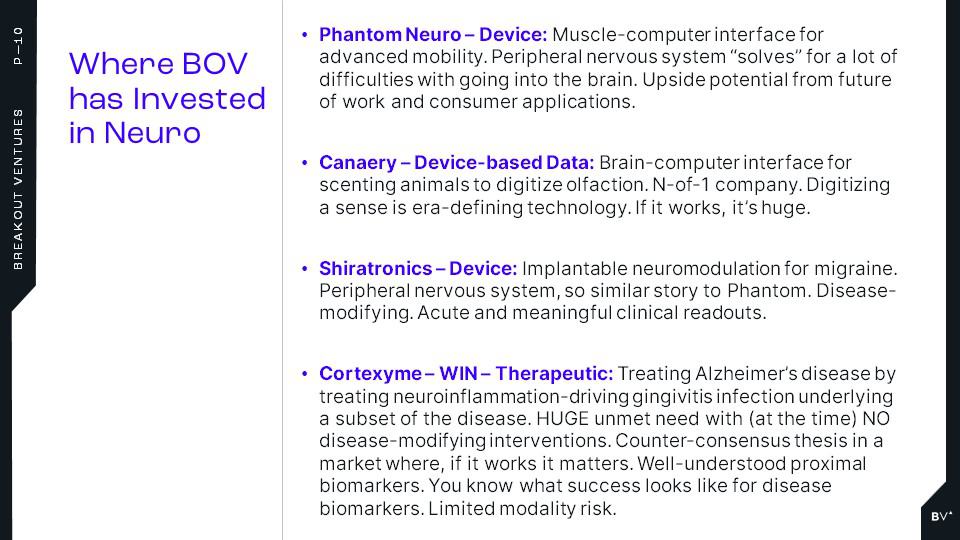

Dana is a Partner at Breakout Ventures, where she drives the firm’s seed investment strategy and supports company founders as they achieve commercialization milestones. She has led due diligence on notable Breakout investments, including Canaery, Phantom Neuro, and Vitra Labs. Dana’s doctoral research culminated in her co-founding a molecular diagnostics spinout company. Dana’s involvement in the entrepreneurial ecosystem in St. Louis continued as she joined the university's entrepreneurship center to institutionalize support for SBIR/STTR-funded spinouts. Before joining Breakout in 2021, Dana was a Senior Investment Associate for the strategic healthcare venture fund Ascension Ventures. Dana has nurtured a robust professional network through her mentorship activities and engagement as a Kauffman Fellow. She holds a PhD in cellular and molecular neurosciences from Washington University in St. Louis.

Summary:

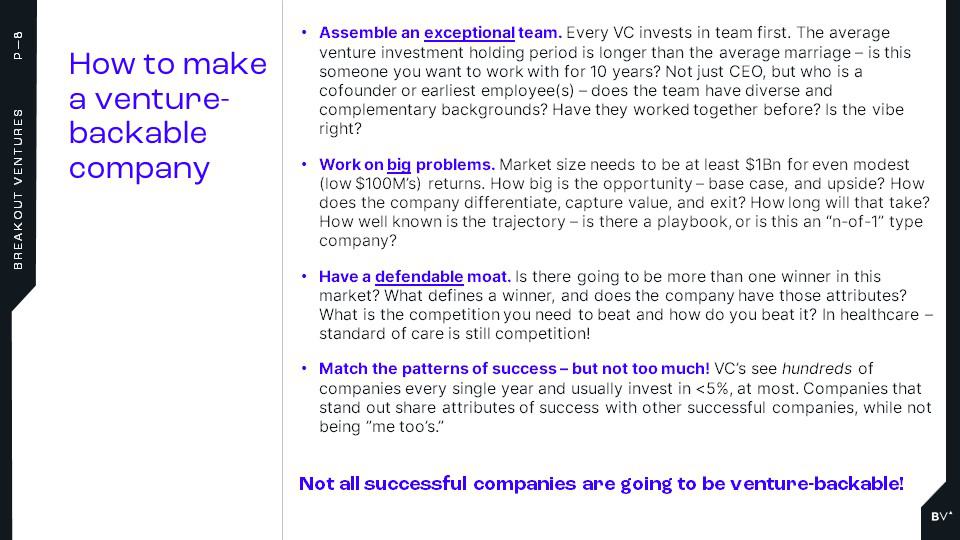

A PhD-trained neuroscientist talks about their path to becoming a partner in a VC firm and how venture investors think about investing in “deep tech” like neuroscience. She dives into neuroscience investing in particular and how to build a venture-backable neuroscience company, and highlights examples from her firm’s portfolio in neurotech.

Challenge:

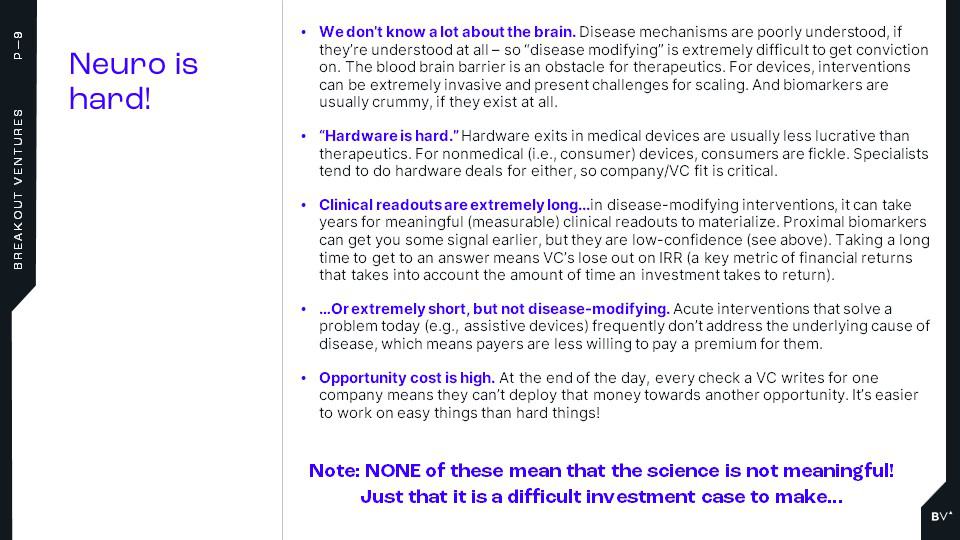

Neuroscience will remain difficult to invest in until meaningful biomarkers are developed, and meaningful biomarkers rely on better understanding of neuroscience disease mechanisms. We’re at an inflection point for a lot of enabling technologies that will drive this change, so I am bullish on the next 10-20 years of progress.